Canada's Most Trusted Broker

With 19+ years of experience and 1000+ clients, Yogesh Bansal simplifies home ownership and refinancing.

YOGESH BANSAL

Your Trusted & Certified Broker

Yogesh Bansal simplifies the mortgage process so that you can focus on your next big move.

Rated 4.96 stars by over 1000+ happy clients.

Why Canadians Trust Yogesh Bansal

- 19+ Years of Mortgage Expertise

- Award-Winning Broker with 1000+ Clients

- Access to 100+ Lenders Across Canada

- Transparent Advice with Zero Hidden Fees

- Fast Pre-Approvals & Tailored Loan Plans

Trusted By Thousands Across Canada

EXCELLENTTrustindex verifies that the original source of the review is Google. I recently had the pleasure of working with Keystone Financial Services for my mortgage, and I couldn’t be more impressed with the level of service I received. From start to finish, the team was professional, knowledgeable, and extremely supportive throughout the entire process. They took the time to explain all the available options, answered every question with patience and clarity, and made sure I felt confident at every step. Their commitment to customer satisfaction truly sets them apart. What could have been a stressful experience turned out to be smooth and efficient, thanks to their dedication and expertise. I highly recommend Keystone Financial Services to anyone looking for reliable and excellent mortgage support. Thank you once again for your outstanding service!Posted onTrustindex verifies that the original source of the review is Google. Great experience working with Yogesh. It was our second time getting our mortgage done from the team. Everyone was super helpful.Posted onTrustindex verifies that the original source of the review is Google. ⭐️⭐️⭐️⭐️⭐️ Great Experience with Yogesh & Anchal! Yogesh and Anchal were amazing to work with—professional, responsive, and super helpful throughout the mortgage process. They made everything smooth and stress-free. Highly recommend them!Posted onTrustindex verifies that the original source of the review is Google. Yogesh and team are absolutely amazing. They helped us with our mortgage every step of the way and made the entire process so simple and easy. I would recommend their service to everyone.Posted onTrustindex verifies that the original source of the review is Google. Yogesh was very helpful and friendly throughout the process. He took time to address any questions or confusion we had. I would recommend anyone in need of mortgages or other financial services to Yogesh and his team.Posted onTrustindex verifies that the original source of the review is Google. Amazing service and a super helpful team! This was our second time working with Yogesh, and just like before, he explained everything clearly and made the whole process smooth and easy.Posted onTrustindex verifies that the original source of the review is Google. Complete end to end solution providers. Very transparent company. Goes above and beyond tons to help their clients. Highly recommend Yogesh and his teamPosted onTrustindex verifies that the original source of the review is Google. I am very pleased to work with Mr.Yogesh . He is knowledgeable and very Experienced.Posted onTrustindex verifies that the original source of the review is Google. ⭐⭐⭐⭐⭐ An Absolutely Seamless Experience with Yogesh Bansal! From start to finish, working with Yogesh Bansal was nothing short of exceptional. Buying a home is one of the biggest decisions you can make, and Yogesh made the entire mortgage and home-buying process feel smooth, stress-free, and even enjoyable! His deep knowledge of the market, clear communication, and dedication to getting the best possible outcome made all the difference. He was always available to answer questions, explain every detail, and offer expert guidance every step of the way. Thanks to Yogesh, we’re now in our dream home with a mortgage that fits perfectly. I couldn’t recommend him more highly to anyone looking to buy a home — he truly goes above and beyond! Thank you, Yogesh, for making this journey an amazing one!Posted onTrustindex verifies that the original source of the review is Google. I had a very smooth experience working with Yogesh, very professional team from start to finish. Yogesh is very knowledgeable and always paying attention to every detail. Very reliable, the team exceeded my expectations.Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

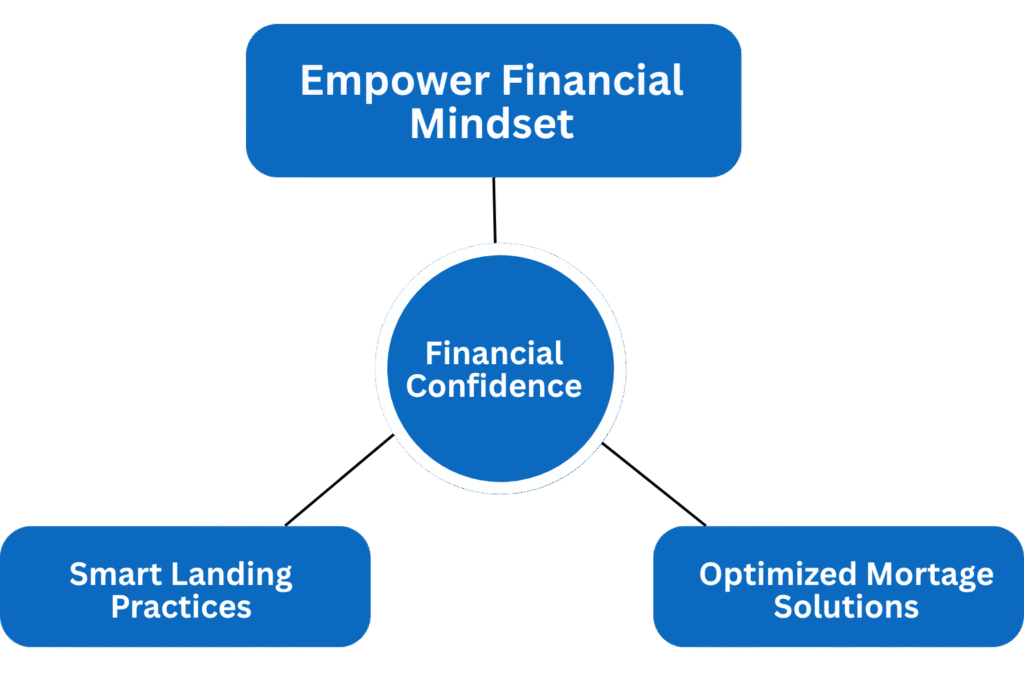

What You’ll Get

Personalized Loan Assessment

Based on your income and future goals

Access to Best Market Rates

From top Canadian banks & private lenders

Hassle-Free Loan Process

We handle the paperwork, you focus on goals

Expert Guidance, Always

From pre-approval to final signing, we're with you

Tailored guidance for every stage

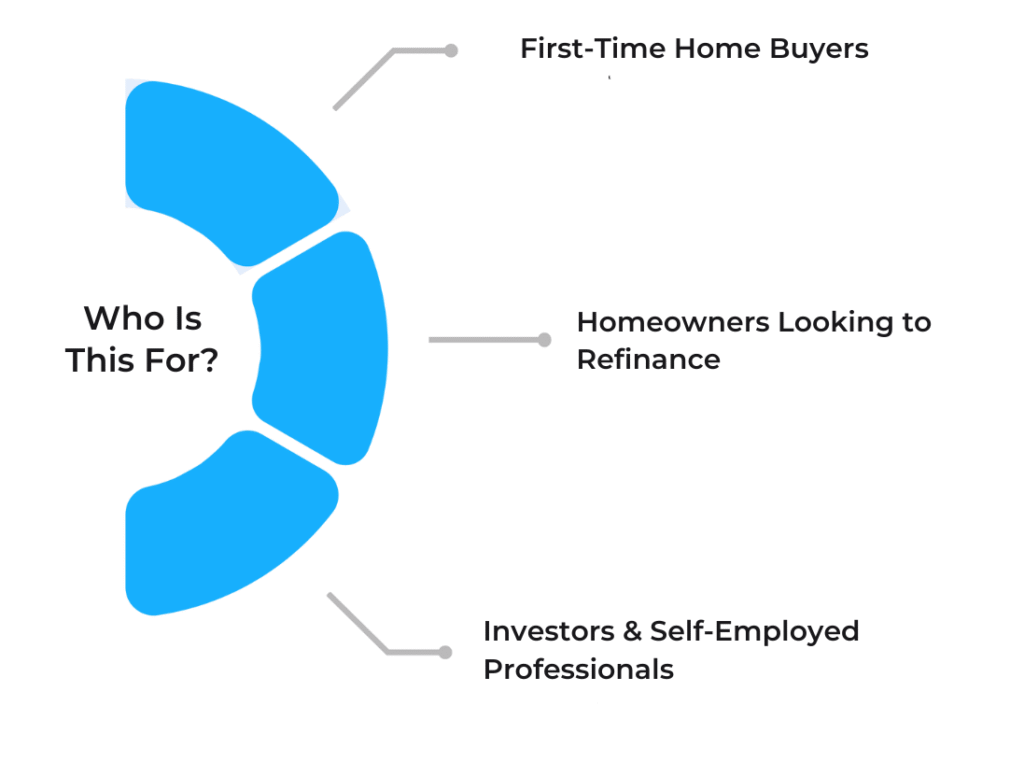

- First-Time Buyer confused by the process?

- New Immigrant unsure about your mortgage eligibility?

- Self-Employed or Freelancer needing flexible solutions?

- Looking to Refinance for better rates or debt consolidation?

- Interested in Real Estate Investment but not sure where to begin?

Recap: What You’ll Get When You Register

Book Your Consultation

Unlock Exclusive Insights and Personalized Mortgage Guidance from Yogesh Bansal.

Still Not Sure? You're Fully Protected.

Expert Mortgage Guidance—On Your Terms

That’s why we’re here—with honest guidance, fast answers, and no hidden fees.

✔️ Quick approvals

✔️ Personalized support

✔️ No pressure

We understand this isn’t just about money. It’s about stability, timing, and peace of mind.

A Promise

No Questions Asked – 100% Money-Back Guarantee

Dear Sir/Ma’am,

My mission is to simplify your mortgage journey and guide you toward the best possible financing solution—completely stress-free. With over 15 years of experience and 2,000+ happy clients, I’m here to offer real guidance, not sell services.

If at any point you feel you didn’t receive value or clarity, know that I take full responsibility. My goal is simple: to empower you with the right information so you can make confident decisions—with no cost, no pressure, and no obligation.

Let’s move forward together—with trust, transparency, and expert support.

Warm regards,

Yogesh Bansal

FAQs

What types of mortgages do you offer?

I work with a wide range of mortgage products including first-time homebuyer loans, refinancing, investment property financing, and self-employed mortgages. I customize each solution based on your unique financial profile.

How do I know which mortgage is right for me?

I provide a free consultation where we assess your income, credit, and long-term goals. Based on this, I help you choose the best-fit mortgage option from top Canadian lenders.

Can you help if I have a low credit score?

Yes. I specialize in helping clients with bruised or low credit find alternative mortgage solutions through private lenders and flexible financing programs.

Do you charge any fees for your services?

In most cases, my services are free for borrowers. I’m compensated by lenders, so you get expert guidance at no additional cost to you.

How long does the mortgage approval process take?

Depending on your profile and documentation, pre-approval can take as little as 24–48 hours. Full approval usually takes 5–10 business days.

Is refinancing a good option right now?

Refinancing can help you lower your monthly payments, access home equity, or pay off high-interest debt. Let’s review your situation to see if it’s the right move.

A Trusted Name in Canadian Mortgages

Yogesh Bansal

With deep roots in the Canadian mortgage industry, Yogesh Bansal has helped thousands of families and investors find customized financing solutions.

Yogesh Bansal is a trusted advisor who simplifies the process, secures the best rates, and helps clients make confident, informed decisions.